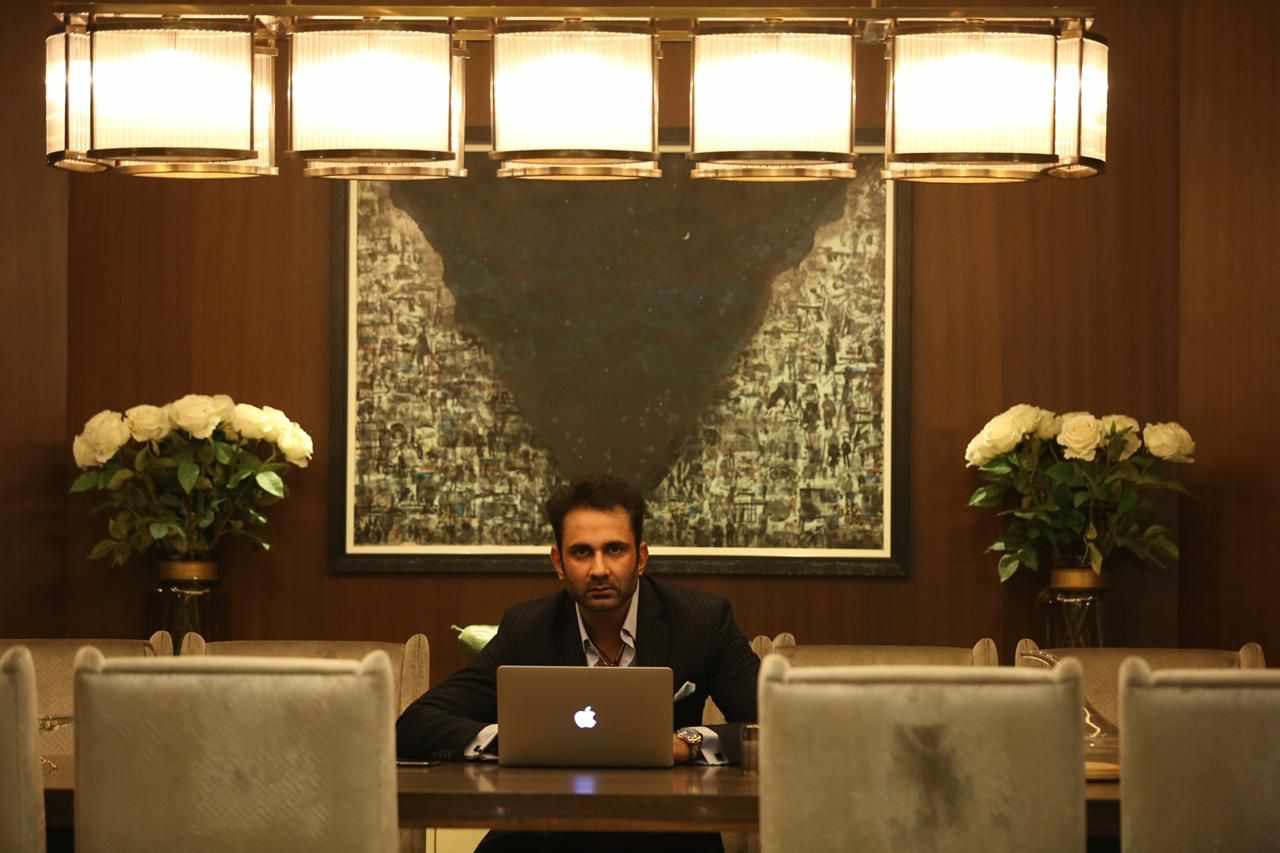

One of the most complex and dynamic sectors in finance is investment banking. The world is high-stakes, fast-paced, and requires complicated financial transaction management. From associate to visionary leader, Mayank Singhvi has learnt a lot in this high-pressure sector over two decades. His worldwide experience makes him an investment banking specialist. Singhvi shares his 20 years of experience in this blog, teaching prospective investment bankers and financial professionals.

1. Build Strong Foundations

All effective investment bankers start with financial expertise. Singhvi started his career in 2002 as an Equity Capital Markets associate at Merrill Lynch. Singhvi learnt the foundations of investment banking—how stock offers operate, how markets respond to financial events, and how to manage risks and client expectations—here.

Singhvi advises newcomers to study corporate finance, valuation, and market dynamics. Understanding numbers and their tales is essential. This comprehensive approach helps dealmakers assess both short-term and long-term impacts of actions.

2. Be Flexible and Grow

The investment banking industry changes constantly. New market trends, regulatory changes, and technology advances keep the sector changing. Singhvi has learnt the value of adaptation throughout his career.

After Merrill Lynch, Singhvi worked at Ernst & Young, ICICI Ventures, and Country Garden Group, gaining real estate, private equity, and infrastructure expertise. His story shows the importance of learning and diversifying. Singhvi emphasises the need to be open to new ideas and venture beyond your comfort zone for progress, especially in investment banking, where flexibility is crucial to compete.

3. Strong Relationships Matter

Investment banking requires technical skills and financial understanding, but also good client, investor, and colleague connections. Singhvi attributes his success to his long-term connections. From Goldstein Roth & Co. to Vista Equity Partners, he realised that investment banking is about building trust, not simply completing transactions.

Singhvi has found that successful investment bankers are good at customer interactions, clear counsel, and negotiation. Respectful relationships lead to repeat business and recommendations. Singhvi teaches prospective bankers to build trusting, collaborative connections, which are the foundation of success.

4. Work Ethic and Perseverance are Crucial

Investment banking requires courage. It takes long hours, meticulousness, and working well under pressure. Singhvi's career depends on his work ethic. Singhvi has shown perseverance and tenacity from ICICI Ventures to Vista Equity Partners as Senior Managing Director.

He's found that problems are inevitable. Overcoming challenges like tight deadlines, tough clientele, and complicated financial arrangements requires a strong work ethic. Singhvi emphasises keeping focused, optimistic, and motivated to overcome obstacles. He succeeded by staying cool under pressure and tackling challenges head-on.

5. Vision and Long-Term Strategy Matter

The finest investment bankers have long-term vision and strategy, yet short-term rewards are vital. Singhvi has always stressed the significance of evaluating the long-term effects of choices. Singhvi consistently saw the larger picture while running IMK Capital Partners or Country Garden Group.

Singhvi emphasises that investment bankers must learn to predict trends and market developments. Proactively making choices based on long-term development, sustainability, and risk management is required. Top bankers understand emerging market possibilities and threats before they become issues.

6. Ethical Leadership Value

Singhvi thinks ethical leadership is crucial in investment banking. Singhvi has championed ethical decision-making in an industry frequently criticised for its lack of openness and honesty. He has prioritised career choices that benefit clients and stakeholders as well as the bottom line.

He leads with honesty, integrity, and accountability. He underlines that investment bankers must uphold the greatest ethical standards not just because it's right but also because it promotes trust and long-term success.

Conclusion

Mayank Singhvi's rise from investment banking associate to CEO shows what can be achieved with hard work and a vision. Over two decades in the sector, he has learnt the value of solid connections, adaptability, long-term strategy, and work ethic. Singhvi's teachings may help investment bankers navigate the field's intricacies and flourish.

Aspiring investment bankers may succeed and lead with integrity and vision in a changing sector by following these principles.

Write a comment ...